How to set up Magento 2 vat number validation?

The Checkout VAT module is a part of FireCheckout. We added it to the package to help your clients validate VAT numbers during checkout. The option is available now in checkout shipping and billing address forms. We integrated the Checkout VAT with VIES validation service.

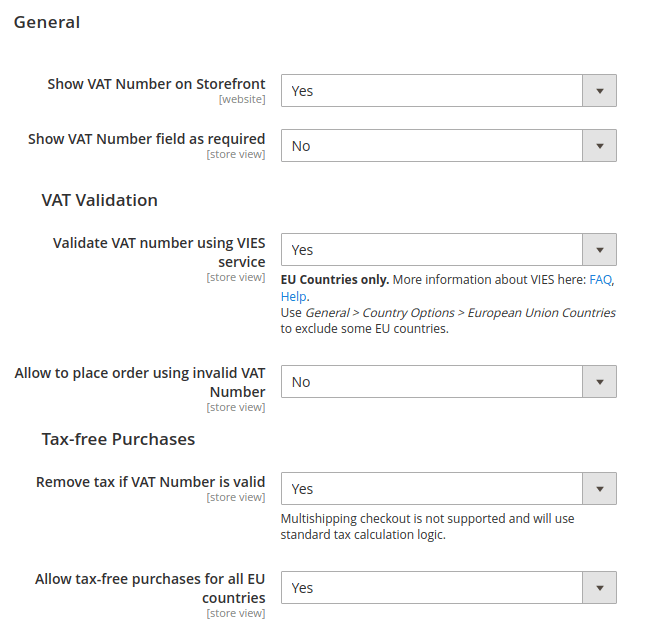

To start configuring the module, go Stores - Configuration - Swissup Checkout - Tax VAT.

General tab

- In the Show Vat Number on Storefront field, set Yes to enable the display of the Vat number field on the checkout page.

- In the Show Vat field as required field, set Yes to make users enter the VAT value during checkout. By default, in Magento 2, the VAT field is set as optional.

Vat validation tab

- In the Validate VAT number using VIES service field, set Yes to check EU VAT via VIES service. It will provide you with the most correct information.

- In the Allow to place order using invalid VAT Number field, set Yes to enable the order placement even if VAT number is invalid.

Tax-free Purchases tab

- In the Remove tax if VAT Number is valid field, set the tax to zero when VAT is valid.

- In the Allow tax-free purchases for all EU countries, you can set the ability to limit countries that have tax-free shopping.

- In the TAX-free applicable EU countries field, select the countries from the EU where customers are eligible for tax-free purchases.