EU VAT Number Validation

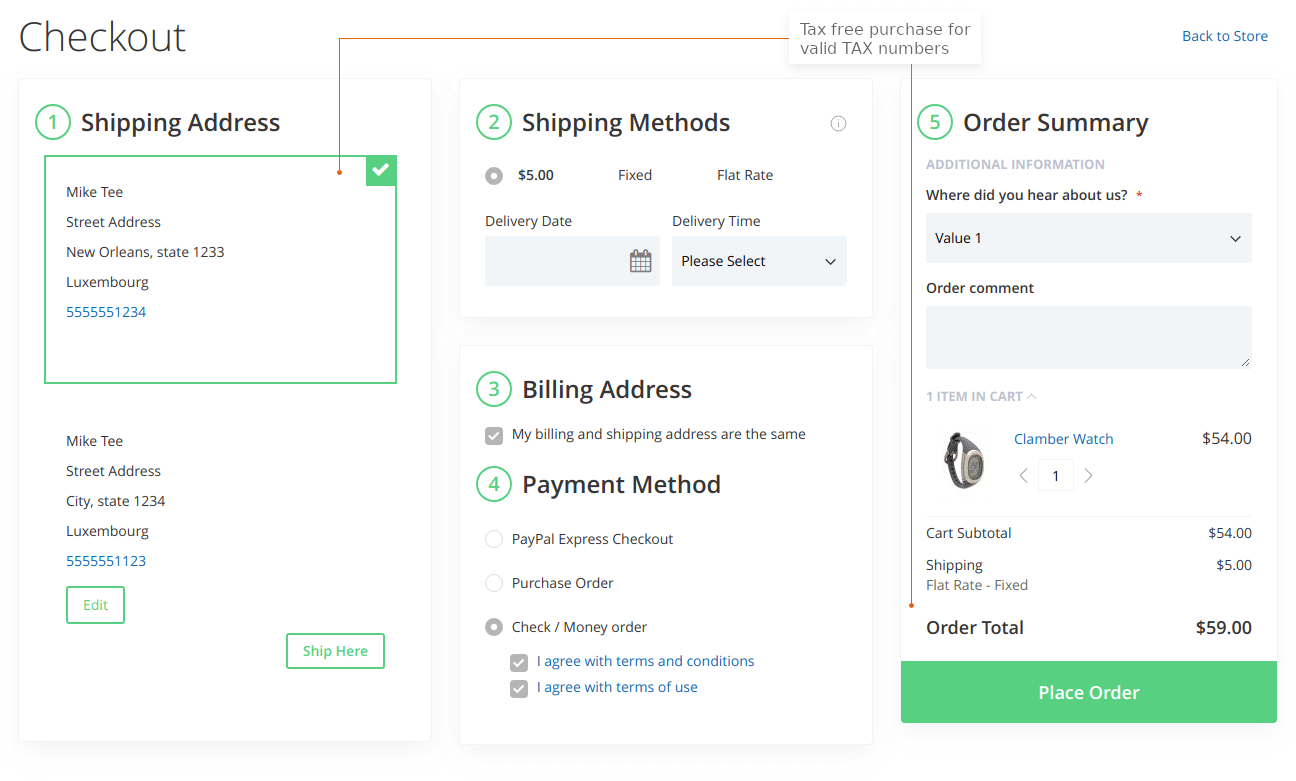

The FireCheckout includes the Checkout Vat module in the package, thereby allowing you to adapt your website for the conditions of the European Union.

It enables verifying the Vat number in checkout shipping and billing address forms. It helps users to validate the VAT field by using the VIES validation service.

The display of Vat field on the checkout page will help you to:

- show your website as a compliant one with VAT regulations

- undertake transactions with VAT-registered customers

- improve B2B sales within the European Union

- help users avoid paying extra money (tax) for the order

- increase customer loyalty and the conversion rate of checkout page

The Checkout Vat module comes with a variety of flexible settings. The aim to simplify the configuring VAT ID validation suggested by default Magento 2. Within the module functionality, you can:

- show vat number field as required, or just disable it

- place it directly to the Street Line 2

- allow placing order even when using invalid vat

- show the message during checkout that users didn't specify the vat number

The message will remind users about providing valid tax numbers in order to avoid paying extra money for the order in the end. Otherwise, the tax will be applied if the number is not valid.

The module includes the improved tax-free purchase configuration. It allows you to:

- set the tax to zero when the VAT number is valid

- limit countries that are applicable for tax-free purchases

- select which countries from EU applicable for tax-free purchases

Get in touch if you have any questions about using the module.